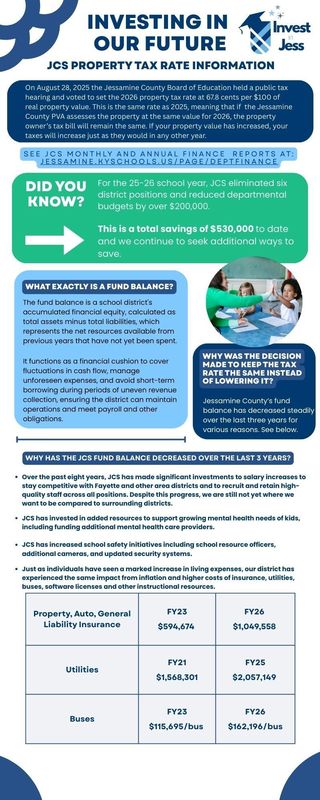

On August 28, 2025 the Jessamine County Board of Education held a public tax hearing and voted to set the 2026 property tax rate at 67.8 cents per $100 of real property value. This is the same rate as 2025, meaning that if the Jessamine County PVA assesses the property at the same value for 2026, the property owner’s tax bill will remain the same. If your property value has increased, your taxes will increase just as they would in any other year.